8558379012 , 5092726196 , 5165029686 , 9138714654 , 8882130059 , 4072037536 , 8778452835 , 5403403769 , 5614028224 , 8132795002 , 4805503294 , 8005045706: How to Profit From Market Cycles

Market cycles present unique opportunities for investors who understand their phases. Economic indicators such as GDP growth and unemployment rates serve as essential guides. By analyzing trends, investors can identify potential entry and exit points. Strategic asset allocation during different phases, combined with effective risk management, can enhance returns. However, recognizing the shifting dynamics of consumer confidence and market behavior remains crucial for timely decision-making. What strategies might yield the best outcomes in varying economic climates?

Understanding Market Cycles

Market cycles, characterized by periods of expansion and contraction, are fundamental to understanding economic behavior and investment strategies.

Each cycle consists of distinct market phases, influenced by various cycle indicators such as GDP growth, unemployment rates, and consumer confidence.

Recognizing these phases enables investors to anticipate shifts in market dynamics, fostering informed decisions that align with their financial objectives and desire for autonomy.

Strategies to Capitalize on Market Trends

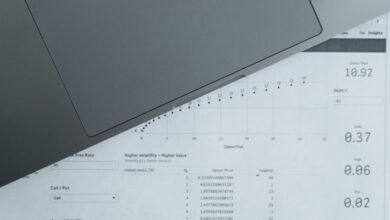

How can investors effectively harness market trends to enhance their portfolios?

By employing trend analysis, investors can identify patterns and shifts in market behavior, allowing for timely decision-making.

Focusing on cyclical investments enables them to capitalize on periods of growth and downturns.

Strategic allocation, based on thorough analysis of trends, empowers investors to maximize returns while managing risks associated with market fluctuations.

Historical Case Studies of Successful Cycle Trading

Analyzing historical case studies of successful cycle trading reveals valuable insights for investors looking to optimize their strategies.

Successful traders have often capitalized on identifiable cycle patterns, enabling them to predict market movements effectively. For instance, those who recognized recurring economic indicators were able to make informed decisions, enhancing their portfolio performance and achieving financial independence through strategic entry and exit points within these cycles.

Conclusion

In the grand circus of market cycles, investors often don the jester's cap, juggling GDP growth and unemployment rates while balancing on a tightrope of consumer confidence. Those who dare to predict the next act may find themselves applauded as visionaries or ridiculed as fools. Ultimately, the savvy investor, armed with diversification and risk management, navigates this chaotic performance, transforming volatile fluctuations into a symphony of returns—if only they can avoid the banana peels of poor judgment along the way.